As a business, you want to keep your customers happy. This can make the prospect of chargeback and dispute resolution particularly disheartening. If you’ve just received your first, then you may be unsure what to do next.

Payment disputes aren’t a pleasant experience for any business owner. Fortunately, there are ways to manage these disagreements and resolve them as quickly as possible, hopefully while retaining your customers.

In this post, we’ll look at what chargebacks are and why they happen. We’ll then share a four-step plan for resolving payment disputes, so you can move onto more positive matters. Let's get started!

Understanding Membership Chargebacks and Why They Occur

A chargeback or payment dispute occurs when a customer contacts their bank and requests a refund for a transaction made on their card. Your payment gateway or merchant will then notify you about the issue. If you believe the chargeback is invalid, you’ll have a period of time to refute the claim.

If the customer wins the dispute, then the value of the transaction will be deducted from your account and returned to them. You may also have to pay a fee to your merchant or payment gateway.

There are many reasons why a customer may initiate a payment dispute. They have the legal right to request a chargeback when the product or service isn't as described, or in the event of fraud. For example, someone may hack into a customer's PayPal account and purchase a product without the account holder's consent.

These are legitimate reasons to request a chargeback. However, in this article, we’ll focus on their misuse. Even if you offer a refund policy, some unscrupulous customers may initiate a payment dispute if they’re unhappy with your product or service.

Other customers may resort to lying about payment fraud. You may even encounter the occasional shopper who receives their products or services as promised but doesn’t want to pay.

Illegitimate chargebacks, sometimes referred to as “friendly fraud”, are on the rise. According to a report by legal research specialists at LexisNexis, the average number of fraudulent attempts to dispute payments per month has risen by 128 percent since 2018. The same report found that up to 43 percent of fraud losses can be attributed to friendly fraud.

Simply being unhappy with their customer experience doesn’t give someone the legal right to initiate a Mastercard or Visa chargeback with their bank. If you suspect a customer is making an illegitimate claim, then you have the right to dispute it.

How You Should Handle Chargeback and Dispute Resolution (4 Key Steps)

Unfortunately, chargebacks are part of running a successful business. With this in mind, here is our four-step plan for resolving payment disputes as painlessly as possible.

Step 1: Do Your Research

The first step is gathering as much information about the disputed transaction as possible. In particular, you should look for evidence that the customer received their product or accessed the purchased service.

For physical products, this might involve checking the delivery tracking ID. For virtual products and services, this step can be more complex.

If you’re using any tracking or analytics software, you can look for evidence of engagement. This might involve proof that the customer has visited your website, logged into their account, or opened emails sent to their address.

If you can prove that the customer opened their account activation email, then this is valuable evidence that they received access to your site as promised.

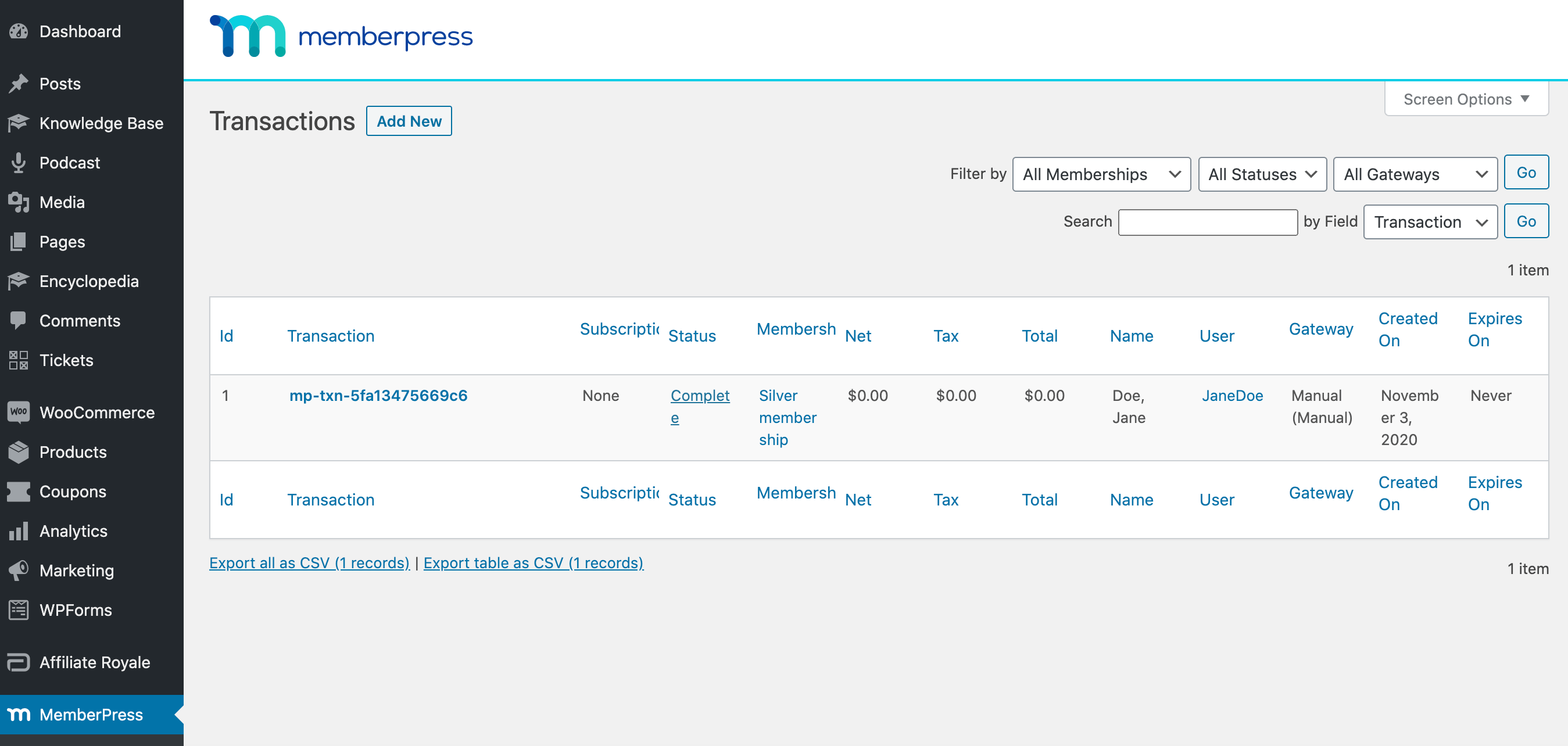

You can also check any software that you use to create or deliver your digital goods. For example, MemberPress records every membership transaction automatically:

You can view detailed information about each transaction by navigating to MemberPress > Transactions. This includes the transaction ID, date and time, and the user(s) involved.

Step 2: Contact the Customer

Your research may indicate that the customer is a victim of fraud. In this scenario, it’s best to accept the dispute. While it’s frustrating to lose out on a sale and incur additional merchant-imposed feeds, it’s not worth risking the bad publicity.

In the age of social media and third-party review sites, a single disgruntled customer can inflict serious damage to your reputation. By dealing with legitimate payment disputes in an efficient, professional manner, you’re presenting your business in a positive light. This may lead to actual sales in the future.

However, let’s assume that your research suggests this isn’t a legitimate chargeback. In this case, it’s usually worth contacting the customer directly. You can politely explain that you’ve researched their transaction and believe you have ample evidence to disprove their claim.

For a customer who knows their claim is fraudulent, this may convince them to drop the dispute. Alternatively, they may respond in a way that casts doubt on their claim or even outright incriminates them. This can be valuable evidence to help strengthen your case.

Regardless of how this interaction plays out, it’s important to keep things polite and professional. Even if your correspondence doesn’t seem particularly interesting, you should also keep careful records of all communications just in case.

Step 3: Respond to the Dispute

Every merchant and payment gateway has their own procedures for responding to chargebacks. However, they’ll typically ask you to write a statement that clearly describes the situation, and to provide supporting documents.

Wherever possible, you should include documentation that proves the customer received what they were promised. For physical products, this usually involves proof of postage and delivery. For digital products, this can include screenshots or PDFs.

It’s also a smart move to provide a copy of your refund policy, if offered. This can prove the customer had another way to recover their money if they were unhappy with the product or service.

Step 4: Be Patient and Accept the Outcome of the Dispute

After submitting your evidence, your payment gateway or merchant will put your case to the customer’s bank. Unfortunately, there’s no guarantee you’ll win.

Even if you submit ample evidence, there are considerable consumer protection laws in place. If you lose the dispute, then it’s best to return the buyer’s funds and pay any additional fees promptly.

This helps you avoid any further negative consequences, including the bad publicity associated with being branded a late payer. It also means you can close this unpleasant chapter and move onto more positive things.

If the dispute involved any kind of membership or subscription service, then you may want to close the customer’s account. MemberPress users can revoke a customer’s membership at any time by navigating to Membership > Members. You can then find the member associated with the dispute and delete their account.

Sometimes, you may want to preserve the customer’s account for your records. In this scenario, you can simply change their login details. If you decide to do so, remember to change the associated email address, too. This ensures the customer cannot regain access to their account by resetting their password.

Conclusion

No one likes dealing with unhappy customers. However, as the old saying goes, you can’t please all people, all the time. Some chargebacks and payment disputes are inevitable, and some may not even be your fault.

If you receive a dispute that you believe is illegitimate, our four-step plan can help you resolve it as quickly as possible:

- Do your research.

- Contact the customer.

- Respond to the dispute.

- Be patient and accept the outcome.

Do you have any questions about how to handle chargeback and dispute resolution? Ask away in the comments section below!

Resolution is totally different from mitigation and this guide covers everything perfectly. I believe the AI boom and its chargeback expansion will significantly improve representment and case results.