As a membership site or SaaS owner, one of the best ways to increase revenue is to attract a steady stream of new paying customers. However, if you’re not doing all you can to keep your existing users, then your marketing efforts could be a waste of time. In most cases, it’s more efficient to retain an existing customer than attract a new one.

Therefore, it’s well worth investing a little time and money in doing all you can to reduce the rate of user turnover of your site. That’s what we’ll discuss in this article, including a look at a tool that can help squash your involuntary membership churn rates.

What Could be Causing 10-20% of Your Membership Churn

We’ve talked about how you can go about reducing your membership site’s churn before on this blog and while ensuring you have the best product out there will help, sometimes it’s the little bumps in the road that can cause a membership to end.

Administrative issues, such as expiring payment details can unintentionally terminate a membership that would’ve otherwise stayed active. If a user forgets to update their credit card details for example, then their membership could end without them even realizing. This is known as passive or involuntary churn and it’s often the easiest type of customer loss to fix. With some sources estimating average involuntary churn rates as high as 10-20% of transactions, it makes financial sense to do all you can to help your happy customers maintain an active subscription.

When it comes to beating passive churn, there’s a purpose-built tool that can put hands-off systems in place to help reduce your membership site’s involuntary churn rate. Using an automated service like this frees up time and resources to let you focus on making your product the best it can be and delivering excellent customer support.

How to Stop to Involuntary Membership Churn and Retain 10-20% of Users

As we’ve just covered, reducing the number of users that end their subscription is one of the core components of increasing your recurring revenue. Taking it a step further, one of the most efficient ways to minimize this user churn is to make it as easy as possible for customers to step over the small hurdles that can trip them up and involuntarily end a membership relationship.

But how do you go about catching the subscriptions that are at risk of ending by accident, without spending all your time on the lookout for the triggers that lead to involuntary membership churn? Thankfully, there’s a tool that was built specifically to solve this problem.

Introducing Churn Buster

If you’re using Stripe to handle payments on your SaaS or membership site, then as well as all the advanced membership site reporting services you can use to grow your business, you can also start using Churn Buster to improve your customer retention rates. Churn Buster is focused on helping you achieve zero involuntary churn. It won’t stop members choosing to quit your service, but if you want to ensure none of your members are leaving by accident, Churn Buster could be for you.

Recovering Failed Payments Before Churn Occurs

The core focus of Churn Buster is resolving issues around failed membership payments. To achieve this Churn Buster will remind members to update their payment details before they expire, help resolve insufficient fund issues, and more. Messages from Churn Buster are delivered via email or through in-app notifications depending on your preferences.

Although part of this approach involves automatically contacting your users when an issue is detected, Churn Buster will also automatically retry to process a payment before disturbing your customers. This optimized retry schedule can help overcome failed payments caused by daily spending limits, temporary holds, and processing timeouts. Churn Buster claims simply retrying a card can recover up to 20% of charges. Stripe does have a retry schedule. However, long after Stripe will have given up, Churn Buster will continue to keep those members at risk from succumbing to involuntary churn in the recovery funnel to maximize retention rates.

A Simplified Payment Update Procedure

Even with the best will in the world, your customers aren’t always going to find the time to update their payment details. Maybe they get the email reminder at the wrong time, open it on their smartphone, or don’t have their login to your site on hand when they’re ready to enter their new card details.

Churn Buster and its card update page templates can help overcome these issues. Although the update pages are hosted on your website and are 100% white label with no mention of Churn Buster, your customers can now securely enter their new payment details through a fully mobile-optimized form that doesn’t require them to log in. Simply by removing those obstacles, you can expect to see your involuntary churn rate reduce.

How Much Could Zero Involuntary Churn Save You?

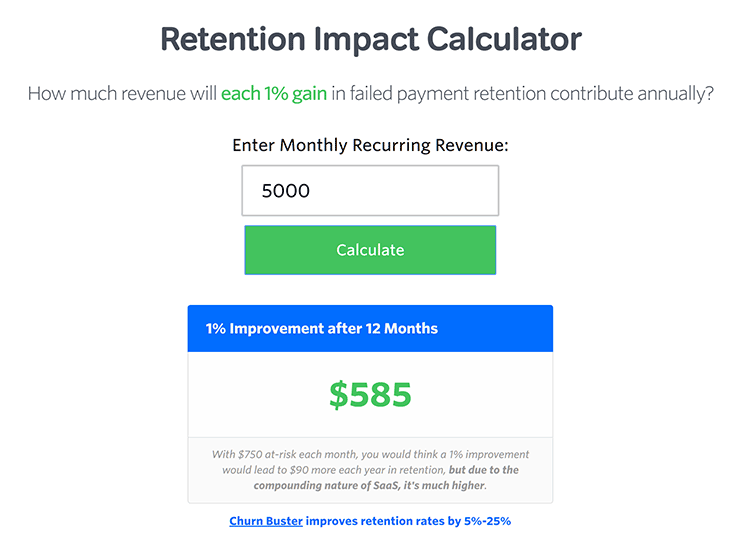

To get an idea of how much a service like Churn Buster could help you, there’s a one percent retention impact calculator on their website. You can also check out the case studies on their website to get a more detailed overview of how this service can help.

As you’d expect from a powerful tool like this, Churn Buster is a commercial service. However, as its sole purpose is to reduce your involuntary churn rate, it should more than pay for itself.

Final Thoughts

The rate at which your customers voluntarily quit your product can be hard to improve. Maybe a user left because there’s another service that better meets their needs, perhaps the problem they had has now been solved, or there could be any other number of reasons why they decided to end their subscription.

While you should definitely work on fixing the issues that lead to voluntary member attrition, you might want to first focus on solving the problems that lead to involuntary churn.

Tackling involuntary churn can produce some quick wins that can really help increase your revenue. After all, if a customer is leaving your service involuntary, due to an administrate issue, then it makes sense to remove that obstacle and ensure they remain a happy user. Often it’s as simple as using a tool like Churn Buster and watching your involuntary membership site churn numbers start falling and your revenue increasing.

How have you been dealing with involuntary churn on your membership site? Would a purpose built tool help improve your bottom line? Please share your thoughts in the comments below.

I’m a little confused. How is this different that the built-in features in MemberPress?

Doesn’t the MemberPress plugin do all of this out of the box? It comes with an Account page where users can update their credit card info, and it can send “Member Notice” emails for failed transactions and expiring credit cards.

I can definitely see the value of Churn Buster for non-MemberPress sites. But if we have Memberpress, why would we sign up for Church Buster?

Hi Brandon, Yes … you’re right MemberPress will do much of this out of the box. You can set up subscription expiring reminders that can be sent to members to try to prevent involuntary churn with MemberPress alone — and these can work very well depending on how structure and word them. We’re just trying to inform our audience about Churn Buster as an alternative to subscription expiration reminders that works very well with MemberPress.

ChurnBuster’s whole business model is geared towards helping customers update their credit cards and so they’ll do several things to recover credit cards above and beyond what can be done in subscription expiring reminders. They’ve figured out the best times to email customers (or not email them) and Churn Buster will actually re-try transactions with Stripe long after Stripe’s built in retry mechanism (something that MemberPress won’t do currently).

So if your churn rates are higher than you’d like (even after using subscription expiration reminders), we thought it might be a good idea to look into using ChurnBuster with your Membership Site to see if it makes a difference in your churn rate.

How does this work with the ‘failed payments’ reminder and ‘credit card expiring’ email messages built into MemberPress?

Would users receive both an email from MemberPress and ChurnBuster?

Gav, you could set it up that way but I think ChurnBuster would probably be an alternative to your reminder emails — if you decided to use it.

Nice! I’ve been eyeing services like this one for potential trial.

Two questions specific to MemberPress:

1. Is there an easy way in MemberPress to get a report on monthly churn numbers in terms of $$$? Having this info would make it easier for me to make the call as to whether paying $149/mo for ChurnBuster would be worthwhile.

2. How does the ChurnBuster payment info update interact with MemberPress?

Avdi,

To your first question … not yet within MemberPress … our current reporting shows the number of failed transactions but not the revenue from those. The reason for this is that many of these failed transactions can be retries by the payment gateway. However, ChurnBuster itself provides a nice interface showing the revenue numbers for transactions recovered. I know that doesn’t get you all of the way there though … so unfortunately for now you’d probably need to analyze the numbers manually to see if it’s making a difference (above and beyond your subscription reminders in MemberPress).

I know we started using ChurnBuster last year and have actually had a chance to analyze the numbers — we’ve seen about a 10% bump in our recovery rate overall. We’re making much more through recovered transactions than we’re paying to ChurnBuster so for us it’s a win … but I’m not sure that would hold true for everyone.

Also, as a side note ChurnBuster has also helped with our customer service reputation. As it turns out, our customers are very happy that we’re not giving up on them and helping them make sure they get their credit cards updated.

As for your second question … I was pleasantly surprised at how easy it was to setup. ChurnBuster gives you an HTML page that you put on your site which is branded with your logo. When the customer receives an email there is a link (with a security token parameter) directly to that page.