You've probably heard the term “tax-exempt” before, but what exactly does it mean?

While you might know your company qualifies for tax exemption, did you know your members can also be exempt? When that happens, you need a way to withhold taxes from their memberships.

Fortunately, MemberPress enables you to make a membership tax-exempt with the click of a button. You can use this setting to turn off taxes…

- For one of more of your memberships

- For a specific client

- If your business model handles taxes on the back end

In this article I'll discuss tax exemption and when you might need to implement it. Then, I'll explain how to make a membership tax-exempt with MemberPress. Let's take a look!

What It Means to Be Tax-Exempt

In simple terms, tax exemption means taxes are not charged or collected under certain circumstances.

While tax exemption is handled differently depending on the state or country you're based out of, there are some general guidelines.

For example, common institutions that are tax-exempt in the United States include:

- Charities

- Religious institutions

- Educational organizations

- Social welfare programs

- Non-profits

However, you should note that not all organizations within these broad categories qualify for tax exemption. In most cases qualifying for exemption requires going through an application process.

Furthermore, tax exemption is often more complicated than just being free to ignore tax laws. It may only affect certain income or transactions and often still needs to be recorded for tax filing.

Plus, some organizations may receive tax breaks rather than outright exemptions.

If you live outside the United States, the process and qualifications will differ. Therefore, we recommend consulting official government documentation to learn more about the regulations.

Why You Might Need to Implement Tax Exemptions

Educational institutions

The most common reason a membership would be tax-exempt is if it applies to a qualifying educational setting.

For example, if your membership provides educational material, you and your members are probably not tax-exempt.

However, if a qualifying educational institution wants to integrate your membership into its syllabus, it may be able to do so without having to pay taxes on it.

Again, this depends on your local and federal laws. Still, the organization in question should know its status and be able to provide some proof that it qualifies for tax exemption.

Offering tax-free membership fees

Another instance where you may want to activate tax exemption is to simplify your pricing by not charging tax to your customers.

This setup may come with extra bookkeeping because you're ultimately responsible for the sales tax.

Still, it would allow you to charge your customers a flat price. You could even use it as a limited-time promotion. This is an effective strategy often used by furniture retailers and automotive dealers.

However, know that turning off tax calculations without being tax-exempt will put the burden of tracking and paying taxes on you. In most cases, it's easier to enable automatic tax calculations unless you have a good reason not to.

Withholding tax from specific customers

If you need to withhold tax from certain customers, you can make a copy of their memberships.

This way, clients with tax-exempt status can sign up for the tax-free version of the membership while other clients use the regular version.

How to Make Your Memberships Tax-Exempt (2 Methods)

Fortunately, activating tax exemption in MemberPress is super easy. In fact, you've probably seen this option before but overlooked it.

This video will show you exactly where to find the tax exemption setting in your WordPress dashboard:

Now we'll explain the different methods you can use to make your memberships tax-exempt!

Method 1: Toggle All Taxes

If your company is tax-exempt, or you don't want to charge taxes on all your memberships, you can turn all tax calculations off in your MemberPress settings.

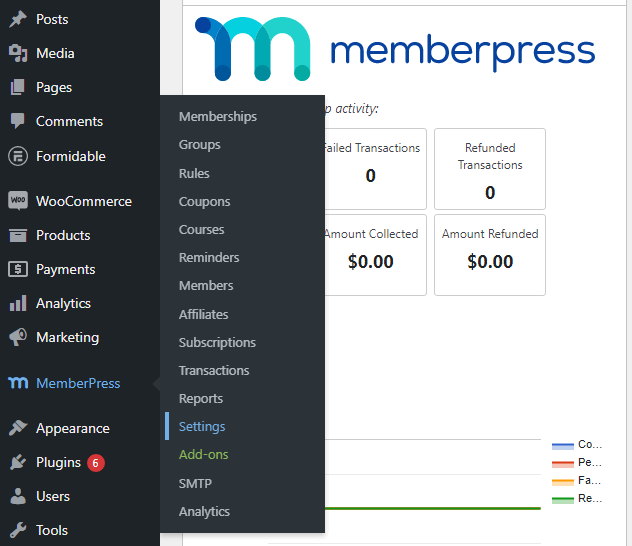

To do this, hover over the MemberPress tab on the left-hand side of your WordPress dashboard and select Settings:

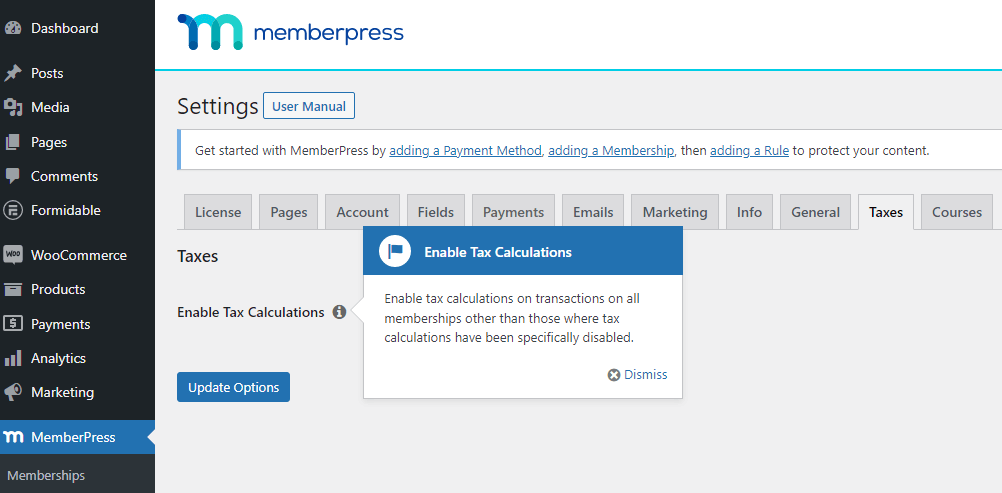

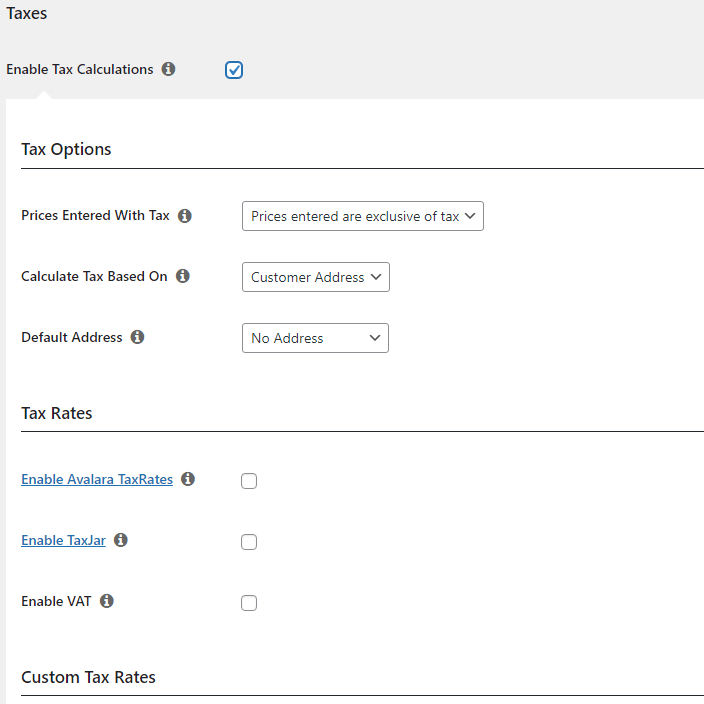

Next, head to the Taxes tab. Here you'll see a checkbox to Enable Tax Calculations:

Checking this box will activate taxes on all your memberships. With the box checked, you will be prompted with additional options for calculating taxes:

If you wish to disable taxes, simply uncheck the box. Remember to click on the Update Options button when changing this setting to make sure it takes effect!

This method is an efficient way to make blanket changes to your tax collection settings. However, you can also set up taxes on an individual membership basis.

Method 2: Toggle Tax Exemption for Individual Memberships

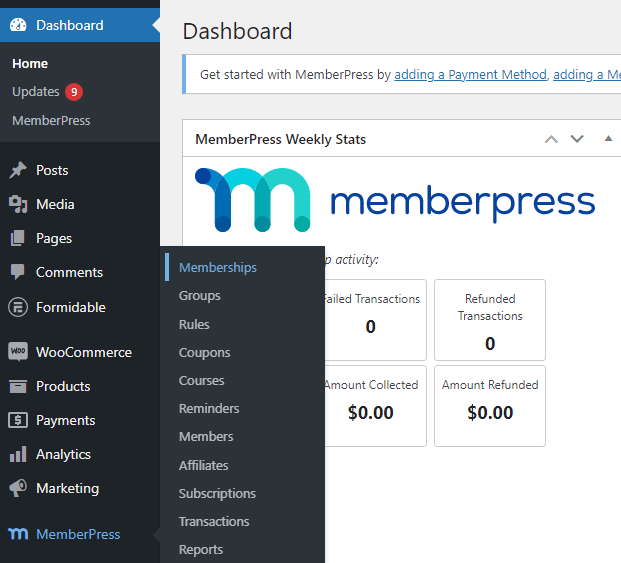

To toggle taxes for individual memberships, hover over the MemberPress tab and select Memberships:

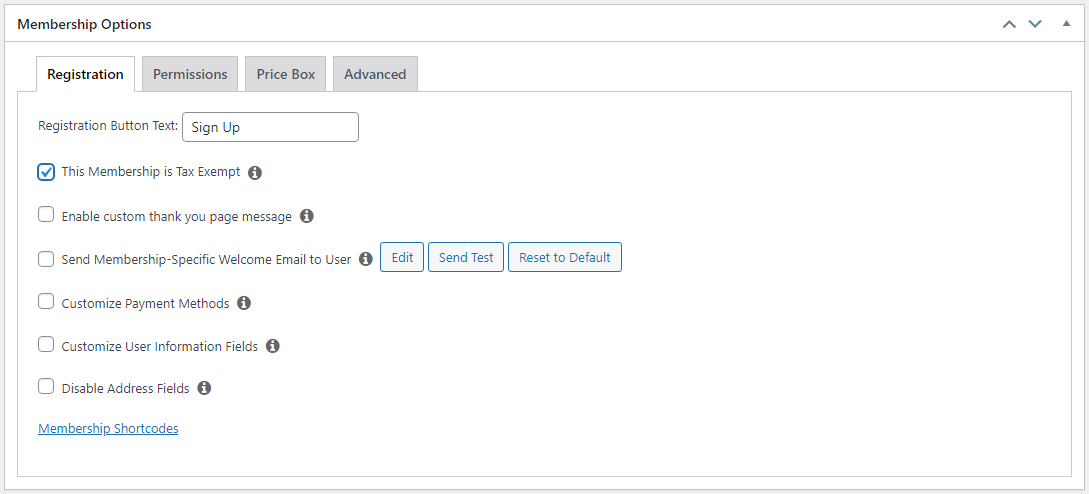

Select one of the memberships you'd like to be tax exempt, and scroll down to the Registration tab under Membership Options. Simply check the box that reads This Membership is Tax Exempt to turn off taxes for it:

Click on the Update button at the top right of the screen to apply the setting. Also, note that this setting will not be available if you haven't enabled tax calculations.

You can check out the previous section of this article if you need help with this process.

Conclusion

You probably don't think much about tax exemption until you need to apply it to your memberships.

Whether your member qualifies for tax exemption or you are simply using the setting to simplify payments, MemberPress plugin makes it easy to apply this setting.

To activate tax exemption for an individual membership, just follow these steps:

- Select Memberships from the MemberPress tab in your dashboard.

- Choose which membership to modify.

- Navigate to the Registration tab in the Membership Options area.

- Check the box that reads This Membership is Tax Exempt.

- Click on the Update button to save the exemption setting.

Do you have any questions about creating tax exemption in MemberPress? Let us know in the comments section below!

If you liked this article, be sure to subscribe to the MemberPress blog!

Add a Comment