As an online business, you can avoid many of the expenses typically associated with running a physical company. This is great for your profit margins, but it can make tax deductions tricky.

Fortunately, there are tax breaks for online businesses. By claiming these legitimate expenses, you can boost your take-home earnings and slash your tax bill.

In this post, we’ll discuss why deductions are essential, even when running a virtual company. We’ll then share four of the best tax breaks for online businesses. Let’s get started!

An Introduction to Tax Deductions (And Why They’re Important for Your Online Business)

Tax deductions are business expenses where you can claim back the tax you would usually be charged. Unfortunately, this isn’t the same as getting the item for free or having your bills completely covered.

However, you can subtract these deductions from your gross income. Therefore, they can reduce the tax you need to pay at the end of the year.

Tax deductions can make your business even more profitable, and they’re available to all companies. They also apply to businesses that operate strictly online.

As a general rule, you can only claim costs for items you’ve purchased exclusively for your business. However, it may be possible to claim partial expenses for services that you use across your work and home life.

If you work from home, these costs may include some of your household expenses, such as your electricity bill. If you use the same smartphone for work calls and personal use, you may be able to deduct the tax on a percentage of your cellphone contract.

To help you claim these deductions, it’s essential to keep detailed records. These can include any receipts, invoices, or email confirmations relating to your expenses. Your bank statements can also be invaluable evidence when doing your tax return.

It’s worth noting that tax is a complicated issue, and the rules often vary depending on your location. For this reason, we always recommend speaking to a tax professional. They can work with you to identify the specific deductions you’re entitled to.

4 Best Tax Breaks for Online Business

As an online business, you can avoid many of the expenses typically associated with running a company. These include commuting costs or renting a warehouse to store all of your stock.

This doesn’t mean you don’t have outgoings! With that in mind, here are four of the best tax breaks for online businesses.

1. Web Hosting

While you could purchase your own server, the vast majority of online businesses pay for web hosting. Your choice of hosting provider and package can have a huge impact on your site. If you skimp on your plan, your website may struggle to withstand spikes in traffic.

You may also notice that your site starts to slow down as you add more content. As such, it could be worth investing in a premium web host:

By opting for a quality hosting provider, you’ll often get access to added extras. These include regular automated backups, security scans, and performance improvements. All of these factors can help you run a more successful and profitable online business.

For these reasons, it’s wise to splash out on the best web hosting you can afford. This means that web hosting often represents a significant expense for your online business – and is a prime candidate for claiming tax deductions.

2. Your Home Office

According to Stanford research, 42% of American employees now work from home full-time. If you’re part of this remote working revolution, you can deduct the costs of running your home office.

To qualify for this tax break, you must have a dedicated office space within your home. It could be anything from a spare bedroom to your basement or even a shed at the bottom of the garden. However, you must be able to prove that this area is primarily for business use.

For example, suppose you run your company from a corner of your kitchen. In that case, you may struggle to convince tax officials that this area isn’t primarily used for other activities, such as cooking.

Assuming that you meet these requirements, you can deduct expenses such as a portion of the mortgage interest. You may also be able to claim tax against any repairs you make to this area.

3. Premium Software

Free software such as WordPress has made it possible to run a profitable online business without investing in premium programs. However, just because something is accessible doesn’t mean it’ll yield the best results:

By investing in world-class software, you can put your site miles ahead of the competition and increase your profits. For example, a premium WordPress theme may instantly elevate your site’s design and performance. It could even earn you more conversions:

Once you recoup the initial cost of the WordPress theme, everything else is profit. Even better, you can claim the cost of this software against tax.

As your site grows, splashing out on proprietary software may become essential for keeping up with demand.

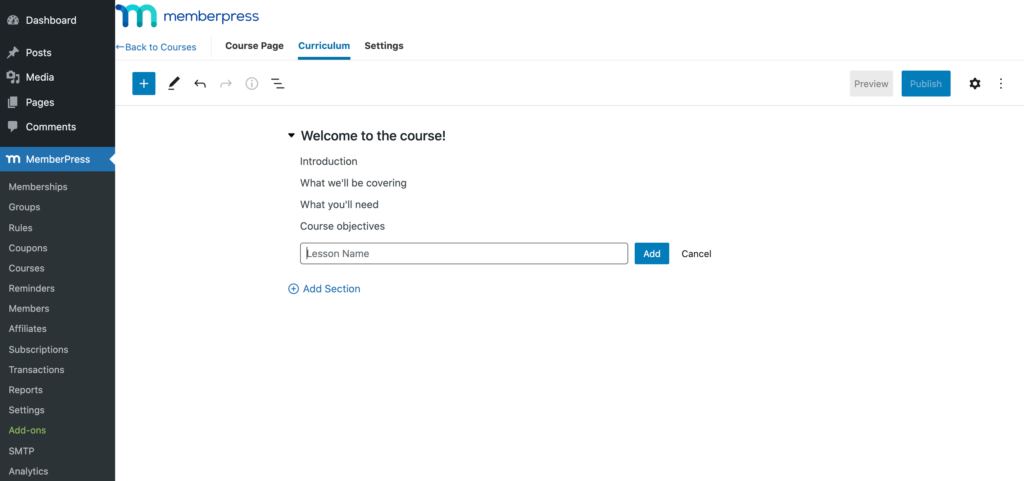

For example, there are plenty of free plugins for setting up a basic membership portal. However, our premium MemberPress plugin includes features that can monetize your community.

For example, you can create and sell courses for your members:

You can even allow your community to purchase memberships as gifts or sell podcast subscriptions. To help you grow your business, MemberPress also integrates with popular marketing solutions, including the ActiveCampaign email automation platform.

4. Training and Education

As a successful business owner, chances are you’re already an expert in your field. However, investing in training can give you an edge over the competition. In today’s fast-paced world, ongoing coaching may be essential for keeping up with the latest developments.

If you purchase online training such as e-courses or recorded webinars, these are often entirely tax-deductible. Coaching can also occur in person.

For example, you might attend a conference or seminar to connect with leaders in your industry:

If you attend in-person training, the cost of admission is a prime candidate for a tax break. However, you may incur additional charges, such as booking a hotel room, arranging transport, or eating out. While you may struggle to deduct 100% of these expenses, you should be able to claim a portion of them against tax.

Conclusion

Running an online-only business can minimize your outgoings. However, you’ll still incur day-to-day expenses. By claiming these costs against tax, you can boost your profit margins and ensure you’re paying no more than you owe.

Let’s quickly recap four of the best tax breaks for online businesses:

- Web hosting

- Your home office

- Premium software, such as the MemberPress plugin

- Training and education

Do you have any questions about reducing your tax liability? Let us know in the comments section below!

If you liked this article, be sure to follow us on Facebook, Twitter, Instagram,Pinterest, and LinkedIn! And don’t forget to subscribe in the box.

Add a Comment